Market Summary

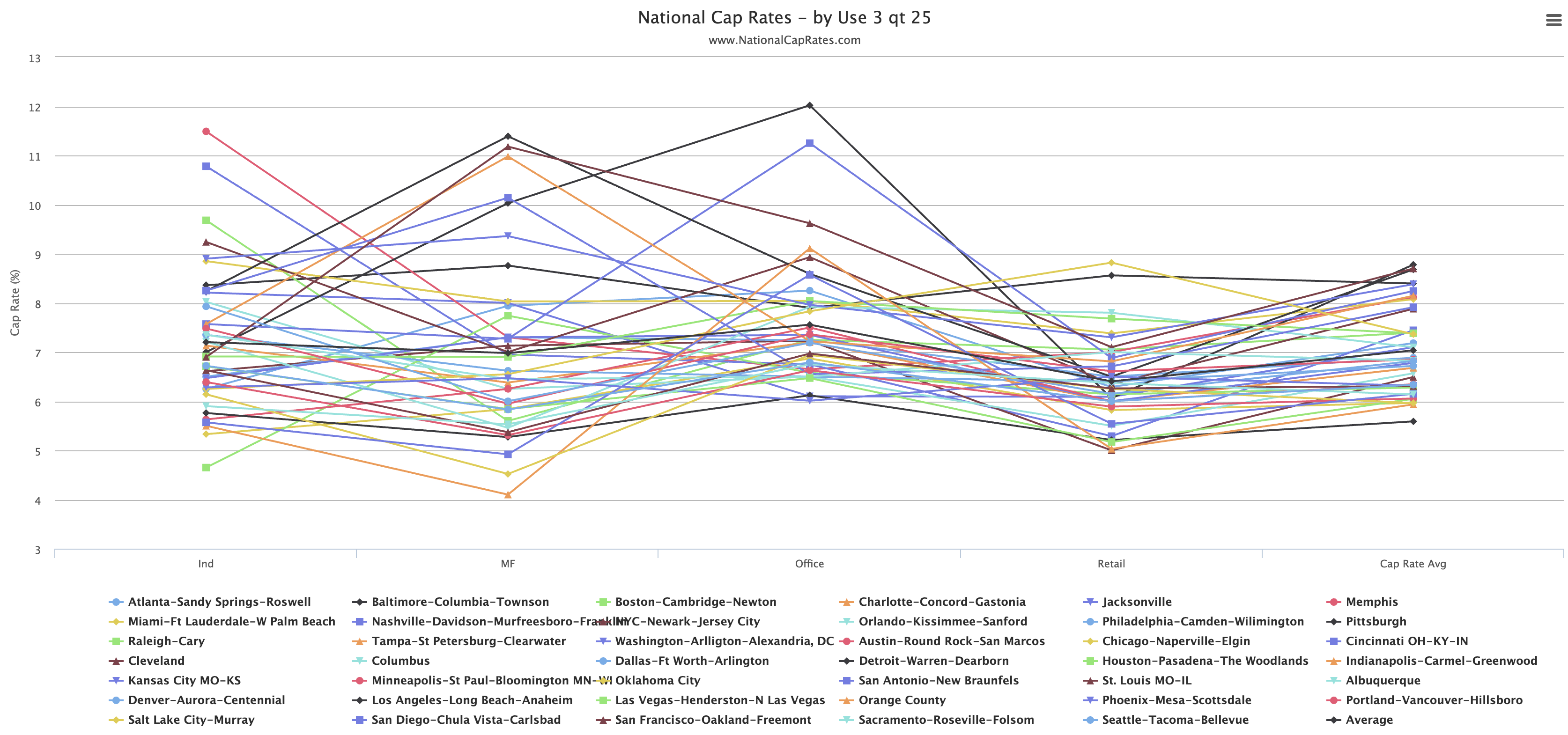

Q3 2025 Cap Rate by City and by Use (Industrial, Office, Multifamily, Retail)

Each month we add thousands of data points. This is a new addition to the Charts and will be upated quarterly. It is currently available on the FREEE STUFF tab in click form.